- Arbitrum’s new proposal may help improve the ordering of transactions on the network.

- Although improvements can be made, overall activity on the network has decreased.

Arbitration [ARB] It has been one of the most popular layer 2 protocols in the DeFi space, having managed to retain its dominance despite several new entrants entering the market.

New developments on the rise

One such development is the proposed adoption of a “Timeboost” policy, a transaction ordering policy. Under the current system, Arbitrum transactions adhere to a first-come, first-served approach.

However, Timeboost would offer a bidding system for listing and placing transactions.

Users will be able to place bids for their transactions, with the highest bidders receiving faster processing and a more convenient location within the block.

Source: Arbitrum

In contrast to the current system, transactions that win a Timeboost auction will be included in a “fast track,” without experiencing any delays.

Transactions that do not participate in the auction will continue to be processed as usual. However, there will be a slight delay of about 200 milliseconds.

This mechanism is similar to the priority fee system used in the OP Mainnet, where users can pay additional fees to speed up their transactions.

Similar to optimism [OP]Proceeds from the Timeboost auction will be directed to the Arbitrum DAO treasury, potentially generating a significant revenue stream.

With the ability to prioritize transactions, users gain more control over their experience on the Arbitrum network.

Time-sensitive transactions, such as arbitrage opportunities or important DeFi actions, can be accelerated using Timeboost. This can lead to a more responsive and user-friendly platform, attracting a wider range of users.

Arbitration case

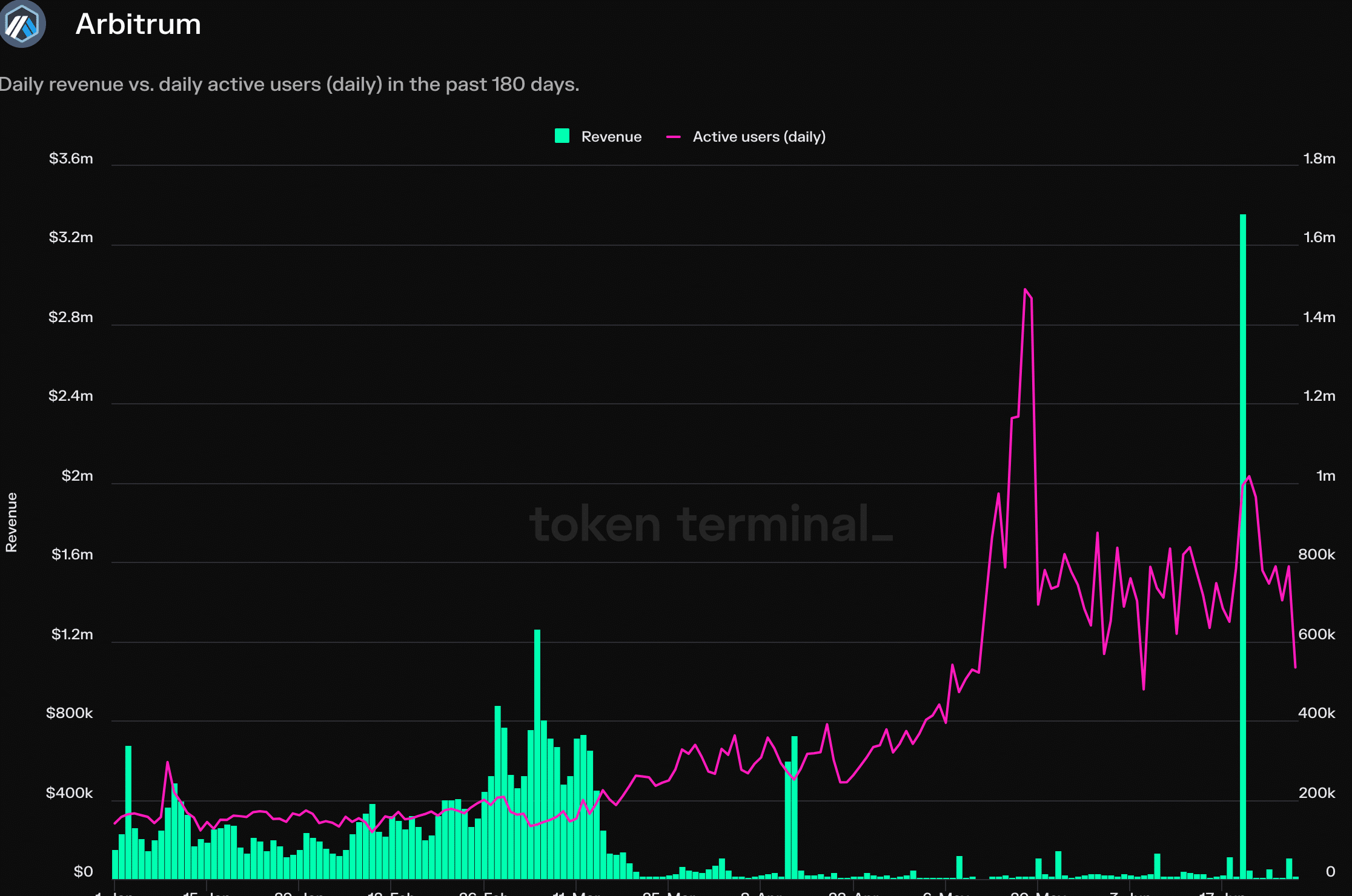

At the time of writing, Arbitrum is having trouble attracting and retaining users.

AMBCrypto’s analysis of Token Terminal data indicates that the number of active addresses on the Arbitrum network has decreased by 38% over the past month.

However, revenue generated by Arbitrum remained high.

Source: Token Station

Whether it’s realistic or not, here’s ARB’s market cap in MATIC terms.

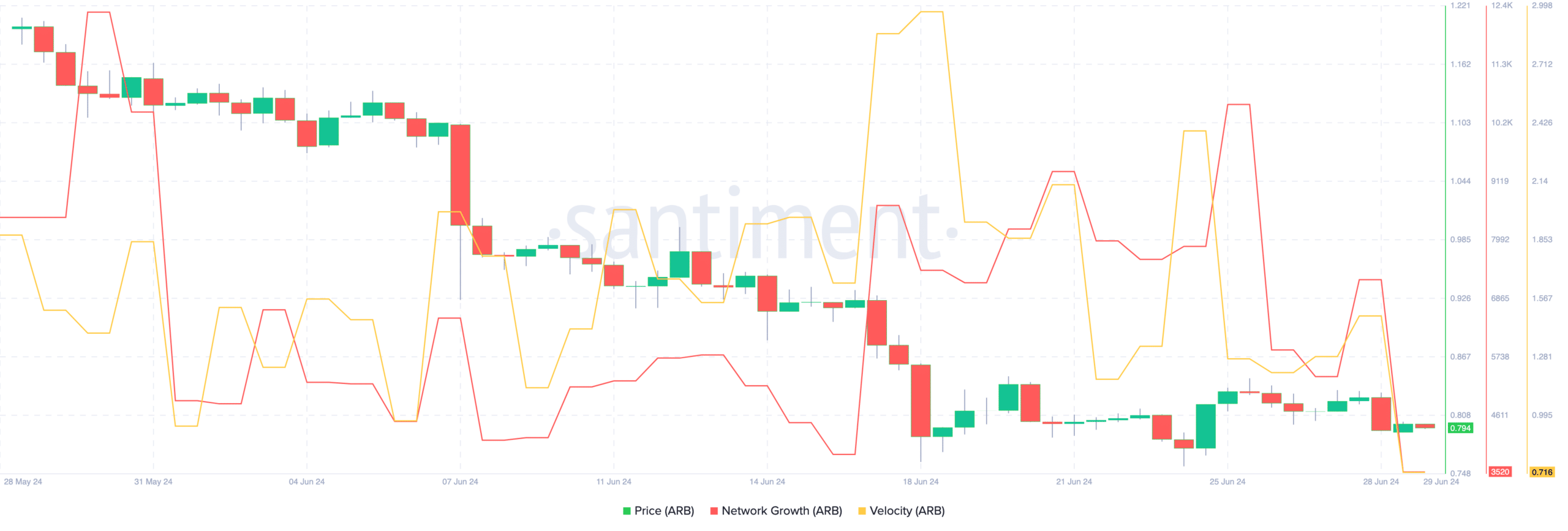

At press time, ARB was trading at $0.7946 and its price had fallen by 3.26% in the past 24 hours. Over the past month, ARB has shown signs of a downward trend.

It was indicated by the lower lows and higher lows that the price showed. The network growth around the token also decreased significantly, meaning that new addresses lost interest in the token.

Source: Santiment

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

/cloudfront-us-east-1.images.arcpublishing.com/tbt/3LM2TS7YNVEENCFUCCTXLDSHOM.jpg)

More Stories

Thousands of homeowners with adjustable-rate mortgages are about to face the pressure of higher monthly payments.

Reuters says Nvidia will be hit with a French antitrust complaint

Analyst says Nvidia will generate such a huge “cash flow” that it will have to buy back more shares because all that money has nowhere else to go