A leading company in the field of artificial intelligence chips Nvidia One technical analyst predicted that Apple would achieve enormous wealth in the coming years, and that shareholders would receive rewards.

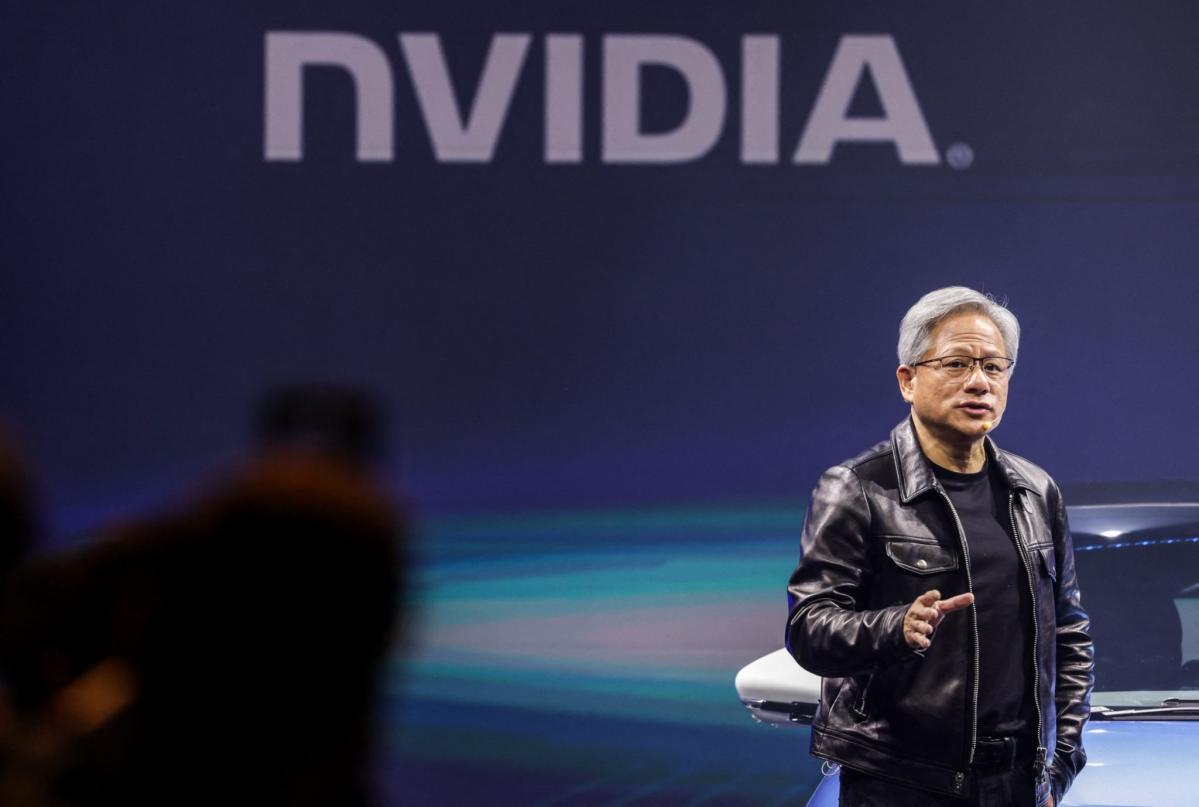

Ben Raitzes, Managing Director and Head of Technology Research at Melius Research, He told CNBC on Wednesday, Jensen Huang’s Nvidia has mastered the “full stack” approach with its hardware and software, giving it a major advantage in AI.

“What they’ve done is they’ve built a computing language and an ecosystem that allows you to monetize AI, and they’re clearly doing that very well,” he said.

Reitzes has a $160 price target on Nvidia stock, implying a 30% upside from Friday’s closing price. Despite Continuous sales The stock, which he started earlier this month, is up 150% so far this year after more than tripling in 2023. Of the seven hot stocks he covers, Nvidia has the most upside ahead, he added.

Another big advantage Nvidia has over its competitors is its annual cadence of innovating new products, Ritzes said. This means developers and customers will know where Nvidia is headed and can budget upgrades accordingly.

“They’re running 150 miles an hour while others are running 100 miles an hour. It’s going to be hard to catch up with these guys,” he added.

Given Nvidia’s advantage in the burgeoning AI space, Melius Research expects the company to generate $270 billion in cash over the next three years, paving the way for huge returns for its shareholders.

Management may not be keen to promote the possibility of share buybacks because such matters are typically associated with older companies, Raitzes said. But in his opinion, the matter is clear.

“Nobody talks about this, and when you implement the model we do, it makes a lot of money,” he said. “And there’s nothing they can do. This government won’t let them buy anything big. They can’t invest that much in R&D. It’s just impossible. So we have to get it as shareholders.”

To be sure, Nvidia has been returning capital to shareholders. In August, A. announced $25 billion buyback programLast month, Nvidia increased its quarterly dividend by 150% from $0.04 per share to $0.10, which equates to $0.01 per share after the split.

Nvidia declined to comment on the possibility of further stock buybacks.

For his part, Retzis was quick to point out that any future buybacks would not imply that Nvidia has stopped growing. “It’s not an insult to buy back stock if you have nothing else to do.”

Nvidia’s latest financials show that its ability to generate cash is accelerating. In the fiscal year For the quarter ended January, Nvidia’s net cash provided by operating activities rose to $28.1 billion from $5.6 billion a year earlier.

And in First Quarter Which ended in April, net cash from operating activities was $15.3 billion — already more than half of last year’s total.

Meanwhile, Huang told investors last week that Nvidia will remain the gold standard. to produce AI training chips amid concerns that rivals could cut into its market share.

Nvidia launch Blackwell The system later this year will only consolidate that progress, he said at the company’s annual shareholders meeting on Wednesday.

“The Blackwell architecture platform is likely to be the most successful product in our history and even in the entire history of computing,” Huang said.

This story originally appeared on Fortune.com

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/FZXBYUGKMRATRFBD7CMPEDQBBM.jpg)

More Stories

All Bob’s stores to close after 70 years in latest US retail loss

Black Farmers Association Calls for Tractor Supply CEO to Resign After Company Cuts DEI Efforts

Here’s the Biggest Threat to $10 Trillion Nvidia