- Bitcoin’s value has fallen by more than 4% in the past seven days.

- Market indicators continue to remain bearish on BTC.

Bitcoin [BTC] The performance over the past seven days has been disappointing, with its price falling below the $65,000 level. Price corrections sparked fear among investors. However, this trend may end soon as historical trends point to a potential bottom for the market.

Bitcoin hits the market bottom

Coin Market Cap Data It revealed that Bitcoin has fallen by approximately 4.5% in the past seven days. In fact, in just the past 24 hours, the price of the king of cryptocurrencies has fallen by more than 2%.

At the time of writing, Bitcoin is trading at $63,931.44 with a market cap of over $1.26 trillion.

Meanwhile, Santiment recently published a tweet Highlighting an interesting development. According to the tweet, the market was mainly afraid or uninterested in Bitcoin, with prices ranging from $65,000 to $66,000.

“This extended level of FUD is rare as traders keep giving up,” the tweet stated. “Bitcoin trader fatigue, combined with whale accumulation, generally results in patient reward bounces.”

To find out if Bitcoin is indeed approaching the market bottom, AMBCrypto analyzed Glassnode data.

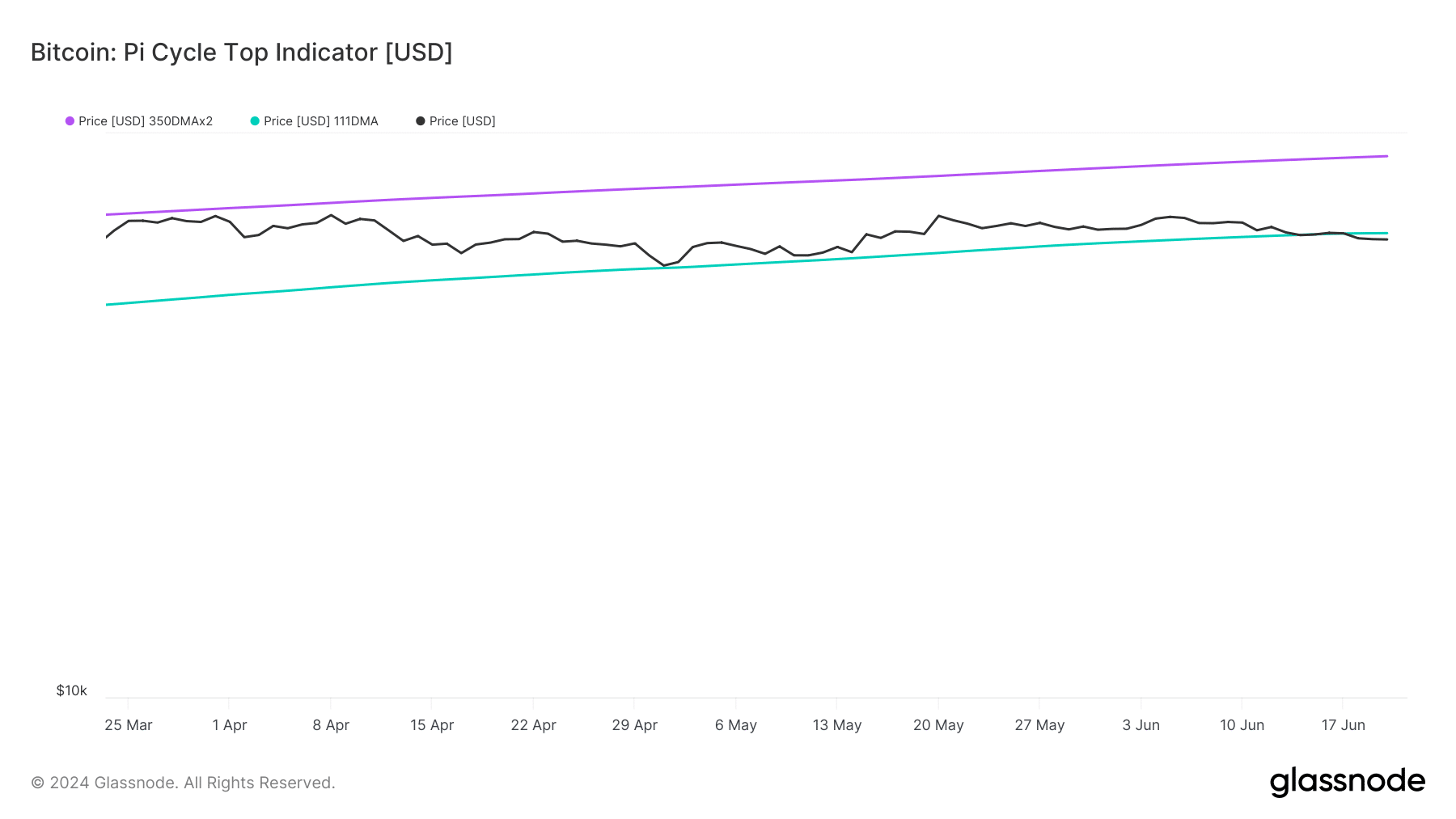

The Pi Cycle Top indicator indicated that BTC price has fallen from the expected market bottom of $66.5K. This clearly indicates a rise in prices in the coming days.

For starters, the Pi Cycle indicator consists of the 111-day moving average and a 2x multiple of the 350-day moving average of the Bitcoin price.

Going forward, if things turn bullish, BTC could also reach a market high of $91k in the coming weeks or months.

Source: Glassnode

I look forward

Like the data above, some other metrics also looked bullish. For example, at the time of writing, BTC Fear and Greed Index With a value of 37%, meaning that the market was in the “fear” stage.

Whenever the gauge reaches this level, it indicates that the chances of an upward rally are high.

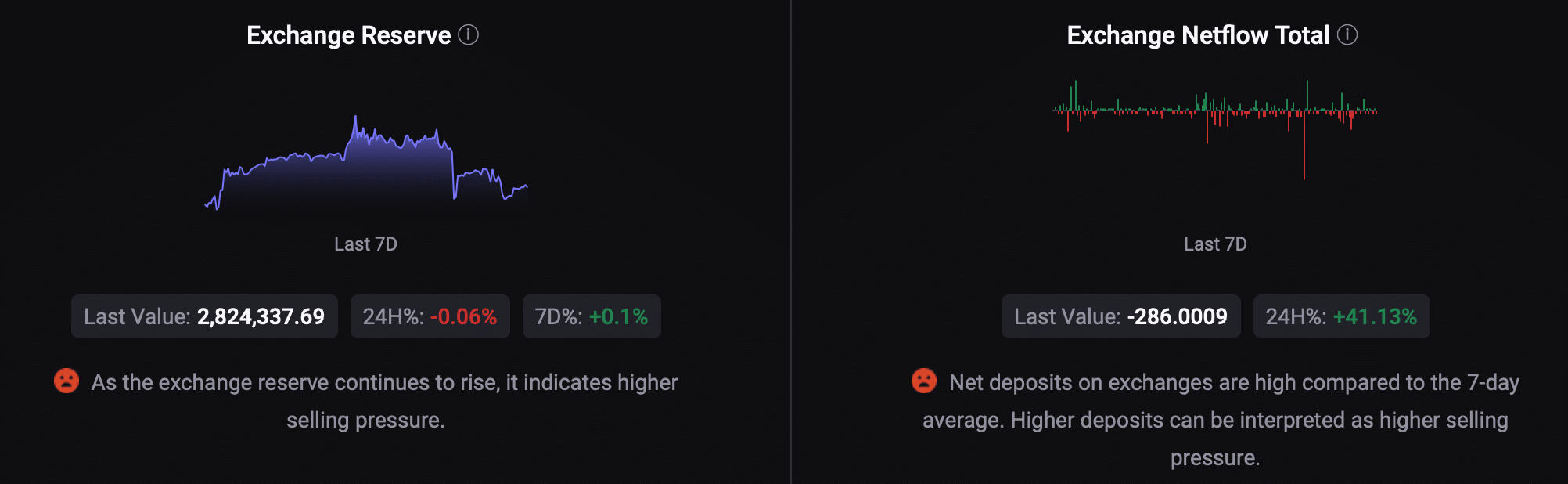

but, AMBCrypto’s look at CryptoQuant data revealed some bearish metrics. For example, the exchange reserve of BTC has been increasing.

Its net deposits on exchanges were high compared to the average of the past seven days, meaning selling pressure on Bitcoin was high.

Source: Cryptoquant

is reading Bitcoin [BTC] Price prediction 2024-25

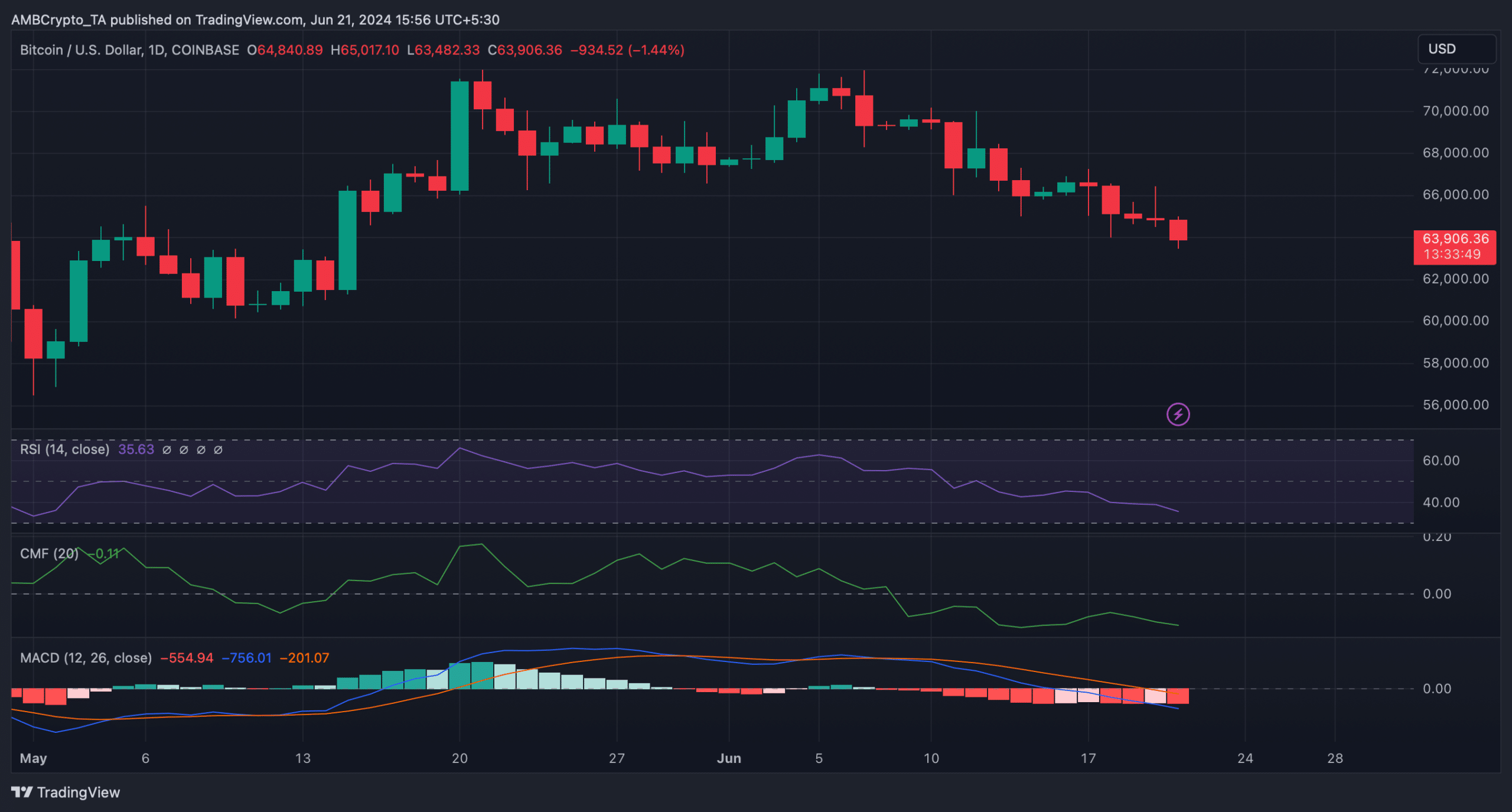

We next planned to take a look at the daily chart of BTC to better understand whether the bulls are preparing for a rally. We found that most indicators were bearish.

The MACD indicator showed a clear downward trend in the market. The Relative Strength Index (RSI) registered a decline. BTC’s Chaikin Money Flow (CMF) also followed a similar downtrend, indicating continued price decline.

Source: Trading View

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

Nike shares fall after the company forecast a bigger drop in sales than expected in 2025

Uber, Lyft Agree to Give Massachusetts Drivers Minimum Wage

Stocks fluctuate after key data with Micron falling